Via Interactive Brokers' secure website.

Interactive Brokers Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- IBKR Mobile

- TWS for PC

- IBKR API

- Portal of clients

- SEC

- FINRA

- SIPC

- FCA

- NSE

- BSE

- SEBI

- SEHK

- HKFE

- IIROC

- ASIC

- CFTC

- NFA

- 1978

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- IBKR Mobile

- TWS for PC

- IBKR API

- Portal of clients

- SEC

- FINRA

- SIPC

- FCA

- NSE

- BSE

- SEBI

- SEHK

- HKFE

- IIROC

- ASIC

- CFTC

- NFA

- 1978

Our Evaluation of Interactive Brokers

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Interactive Brokers is a moderate-risk broker with the TU Overall Score of 5.16 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Interactive Brokers clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Interactive Brokers offers more profitable conditions to professionals and is not focused on novice traders.

Brief Look at Interactive Brokers

Interactive Brokers is among the best-known US investment companies, operating since 1977. The broker offers to trade currency pairs, but its basic instruments are stocks, CFD, indices, metals, ETF, futures, and other exchange market assets. You can also trade cryptocurrencies on Interactive Brokers. The company is regulated by the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), the UK Financial Regulatory Authority (FCA), and other international financial regulation commissions. In 2020, the broker was awarded the "Best Online Broker” (Barron's) and "Best Broker for Economical Investments" (NerdWallet) titles and got five stars in the Online Stock Trading for Traders category (Canstar). Also, the broker is popular in other countries. Here you can read reviews of Interactive Brokers in Canada, Singapore, Australia, Hong Kong, Ireland.

- wide range of training materials;

- access to 135 markets in 33 countries;

- a huge subset of trading instruments.

- website interface is only partially translated into other languages;

- you have to pay for an inactive account;

- Support service does not work on Saturday and Sunday;

- long and complex registration procedure;

- no cent accounts for novice traders.

TU Expert Advice

Financial expert and analyst at Traders Union

During its cooperation with Traders Union the Interactive Brokers investment company proved itself as a reliable partner, which faithfully fulfills its obligations to us. The broker provides clients with a wide range of services, allowing them to engage in both active trading and investments. At the same time, the broker charges a fee for an inactive account, and that's not convenient for passive investors.

Despite the lack of a minimum deposit, Interactive Brokers is focused on working with professional market participants. The US and Canadian investors are the main target audiences of the company. Interactive Brokers customer support will help you resolve claims made to the company.

You can find all the information about trading conditions and the specifics of various trading instruments on the broker's website. Before opening an account with this broker, we strongly recommend you to read about all trading conditions in detail, as well as reviews of other clients about cooperation with Interactive Brokers.

Interactive Brokers Summary

Your capital is at risk. Via Interactive Brokers' secure website. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.0% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | IBKR Mobile, TWS for PC, IBKR API, Portal of clients |

|---|---|

| 📊 Accounts: | Real, Demo |

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH |

| 💵 Replenishment / Withdrawal: | Bank Transfer (SEPA), US ACH Transfer, Direct Debit/Electronic Clearinghouse (ACH), Cheque, Canadian ETF Transfer, BACS / GIRO / ACH |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Depending on the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 lot |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds |

| 💹 Margin Call / Stop Out: | Depending on the asset |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant Execution |

| ⭐ Trading features: | Options, trading, CFD, ETF, EPF |

| 🎁 Contests and bonuses: | No |

Interactive Brokers is militantly developing, offering services to investors regardless of their trading experience. For this purpose, the broker doesn’t ask for a fixed minimum deposit but has margin requirements for accounts of various structures to make trading financially safe. The size of the leverage and Margin call and Stop out levels depends directly on the asset that the client is trading.

Interactive Brokers Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

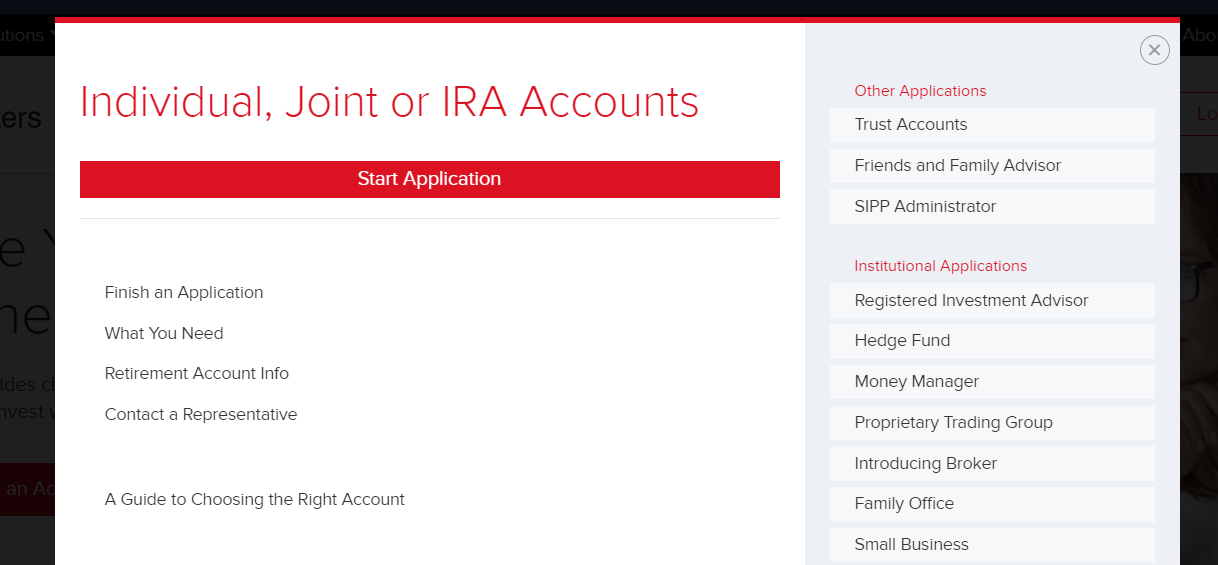

Open a trading account to become a client of the company and start trading with Interactive Brokers. Read more about the registration and functionality in your personal account below.

To get a rebate, register on the Traders Union website, follow the referral link to the broker's page, and click on the "Open an account" button.

Choose the account that fits you.

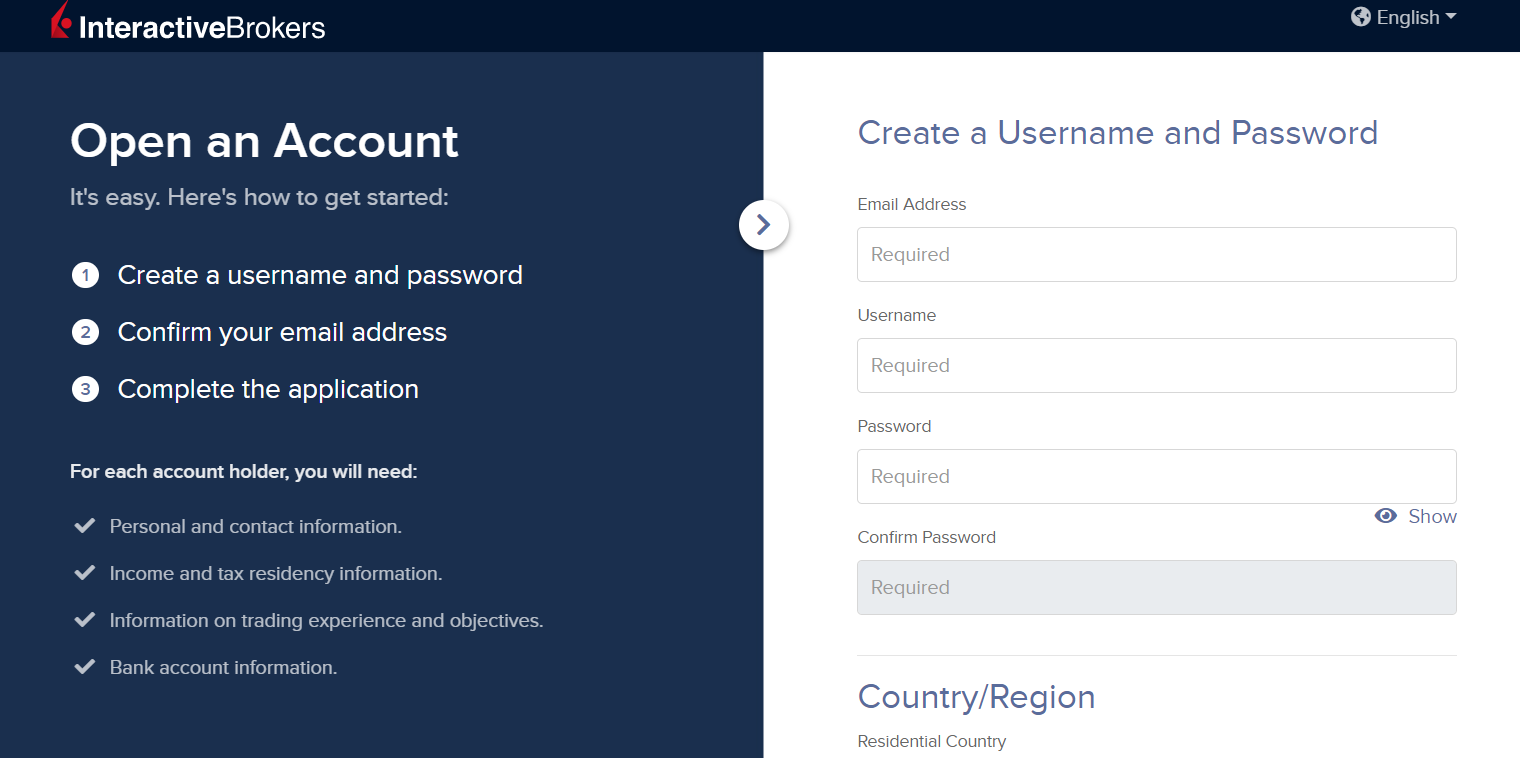

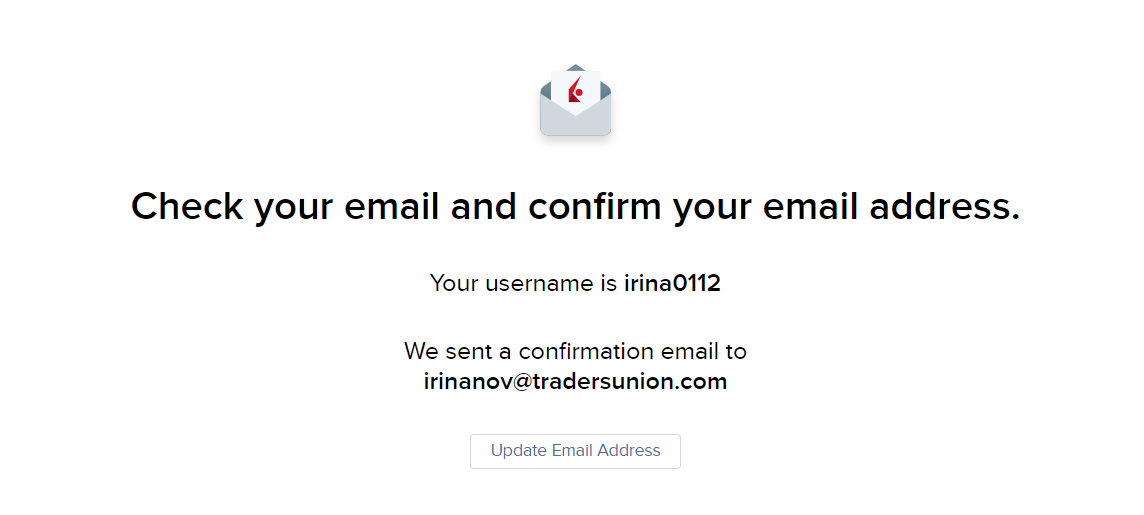

Complete the application to open an account. Enter your email address, full name, country of residence, and create a password to enter.

The next step is registration confirmation. Find a letter from the broker in your mailbox and click the "Confirm Application" button.

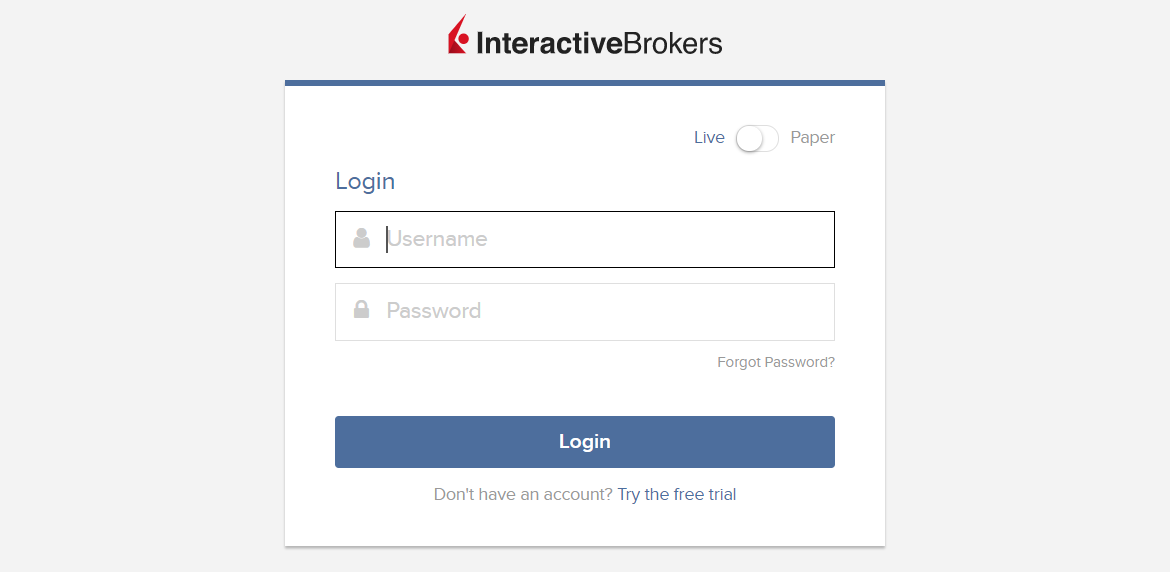

To complete your registration, enter your login and password in the appropriate input.

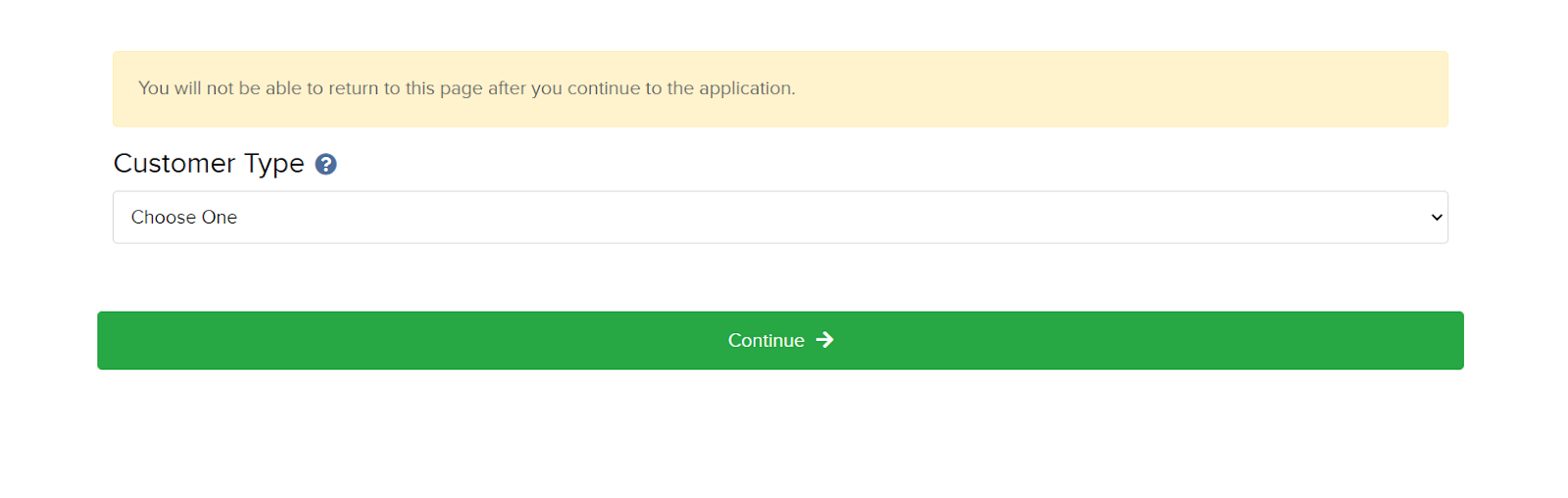

Now select the structure of the account you wish to open.

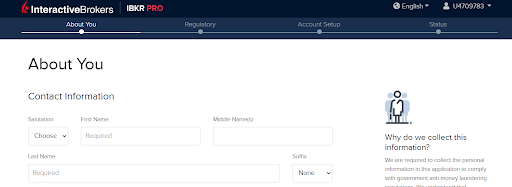

Fill out the profile fields, including contact information, personal information, identification, professional experience, source of wealth, account information, and confidential matters.

All fields are mandatory. After you specify all the data requested by the broker, your application shall be sent for consideration. This procedure takes several days, so you won't be able to start trading immediately.

If your application is approved, you’ll get access to your personal account, where the following functions are available:

Additionally, you now have access to:

-

training materials;

-

quick connection to customer support;

-

statistics for the members of the referral program.

Regulation and Safety

Interactive Brokers is regulated by a variety of international commissions, such as US SEC, FINRA (CRD#: 36418/SEC#: 8-47257), SIPC, UK FCA (208159), Australian AFSL (453554), Indian NSE, BSE (3285), SEBI (INZ000217730), Hong Kong SEHK, HKFE (01590), and Japan, Luxembourg, and Canadian financial supervisory authorities (IIROC).

The licensing to operate is only possible if the broker meets all the requirements of the regulatory authorities. Otherwise, the license shall be denied or canceled.

Clients’ funds are protected by using segregated accounts.

Advantages

- A large number of regulatory authorities

- Clients' capital is protected

- A deposit insurance program

- The documentation is on the broker's website and in the public domain

Disadvantages

-

A large number of regulatory documents to study

A large number of regulatory documents to study

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | From $2 | Depending on the currency and withdrawal method |

Each of the trading instruments has individual margin requirements; you can find them directly on the website.

Interactive Brokers trading commissions were analyzed and compared with the popular broker's characteristics. Find the results below:

| Broker | Average commission | Level |

|---|---|---|

|

$2 | |

|

$1 | |

|

$8.5 |

Account Types

Types of accounts:

The lack of a wide choice of accounts is because trading conditions are significantly influenced by the specifics of the trading instruments used by the client, as well as the trading turnover. Moreover, you can independently adjust trading conditions as you wish, without the need to change the type of trading account.

Deposit and Withdrawal

-

Apply to withdraw funds. Proprietary payment systems set limitations on the maximum withdrawal amount. One withdrawal per calendar month is free, but there is a commission for subsequent withdrawals, depending on the account currency and the payment system.

-

For deposits and withdrawals, you can use bank transfer (SEPA), direct debit or wire transfer through the ACH Clearinghouse, cheque, Canadian ETF transfer, US ACH transfer, and BACS/GIRO/ACH.

-

The speed of withdrawing money and crediting funds depends on the payment system.

-

Replenishments and withdrawals are available in 19 currencies: USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH.

-

You are required to pass verification during registration for financial transactions.

Investment Programs, Available Markets, and Products of the Broker

Interactive Brokers casts itself as an investment center, but there are no programs customary to novice investors like PAMM accounts, transactions copying services. Investments are possible by investing in stocks, bonds, and ETFs, earning dividends from them, or subsequent sales at a higher price. The broker offers a portfolio constructor based on a variety of parameters to create an optimal portfolio. Investors also have access to investments in over 34 thousand mutual funds. Big business professionals can invest in hedge funds.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Interactive Brokers affiliate program

Commercial referral program. The partner's challenge is to attract new customers using a unique link, and the partner shall get a fixed amount of $200 for each client attracted.

Referral program with extras. The partner's challenge is the same as in the commercial referral program. The only difference is that now the referrer (partner) gets a percentage of the trading commission that the client invited pays to the broker. Payments are made for 3 years.

There is no need to be a client of Interactive Brokers or be an active trader to participate in the affiliate programs. It is enough to meet the broker's requirements for partners.

Customer Support

If any problems or questions, you can contact the broker's support service, which works around the clock, 5 days a week.

Advantages

- A large number of communication methods

- Multilingual support

- Round-the-clock qualified support 24/5

Disadvantages

- No support on weekends

You can contact the support service by:

-

calling to a phone number on the website;

-

email;

-

contact form;

-

online-chat on the broker’s website.

You can apply for help directly from the website or from the Personal Account.

Contacts

| Foundation date | 1978 |

|---|---|

| Registration address | One Pickwick Plaza, Greenwich, CT 06830 USA |

| Regulation | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA |

| Official site | https://www.interactivebrokers.co.uk/ |

| Contacts |

00800-42-276537,+41-41-726-9500, +44 207-710-5695

|

Education

Interactive Brokers provides clients with useful information to help novice traders to get Forex training and to help novices and professionals to improve their skills.

We highly recommend you use the IBKR trial version to test your knowledge in practice without financial risk.

Comparison of Interactive Brokers with other Brokers

| Interactive Brokers | RoboForex | Pocket Option | Exness | FBS | InstaForex | |

| Trading platform |

Trader Workstation, IBKR Mobile, APIs | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | No | $10 | $5 | $10 | $1 | $1 |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | $5 | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Detailed Review of Interactive Brokers

Interactive Brokers is well-known in the USA. It provides services all over the world and offers traders and investors the best conditions to save and increase their capital. The company's priority is to create technology that will increase the order execution speed and the range of instruments to provide clients with access to advanced assets. Stocks, metals, indices, and other assets of the stock markets are also the primary assets in the company. The broker offers trading in 23 currencies and options for active trading.

A few figures that could be interesting for traders choosing a broker:

-

over 42 years in the market;

-

access to 135 markets within 33 countries;

-

over 1.7 million transactions daily;

-

trading is available twenty-four/six;

-

access to 100+ types of orders;

-

876 thousand accounts opened.

Interactive Brokers is a company for profitable investments and active trading

Interactive Brokers is a tried-and-true company focused on the active development of trading conditions for even more profitable trading and investing. This broker offers two types of accounts, real and demo. The reason is simple enough: trading conditions depend solely on the type of assets the client trades. This means that you can independently adjust the conditions if needed.

For trading, the broker offers to use the Client Portal web platform, the IBKR Mobile application, TWS for PC, and the IBKR API to create your own trading software.

Interactive Brokers’ useful services are:

-

investors' platform;

-

bond platform;

-

a mutual fund platform;

-

portfolio analyst;

-

interactive advisors.

Advantages:

wide range of trading instruments;

access to over 100 international markets;

Wide range of accounts for various structures (private accounts, general, etc.);

No minimum deposit;

bulk training program for clients of different levels of experience;

regulation by a large number of international bodies worldwide.

User Satisfaction