iBroker Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- CQG

- Mobile application

- Proprietary platform

- TradingView

- dt Pro

- StoneX

- S5 Mobile

- AARNA iBroker

- RJO Futures Pro Mobile

- Direct API

- PatSystems

- CNMV

- 2022

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- CQG

- Mobile application

- Proprietary platform

- TradingView

- dt Pro

- StoneX

- S5 Mobile

- AARNA iBroker

- RJO Futures Pro Mobile

- Direct API

- PatSystems

- CNMV

- 2022

Our Evaluation of iBroker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

iBroker is a broker with higher-than-average risk and the TU Overall Score of 3.58 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by iBroker clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

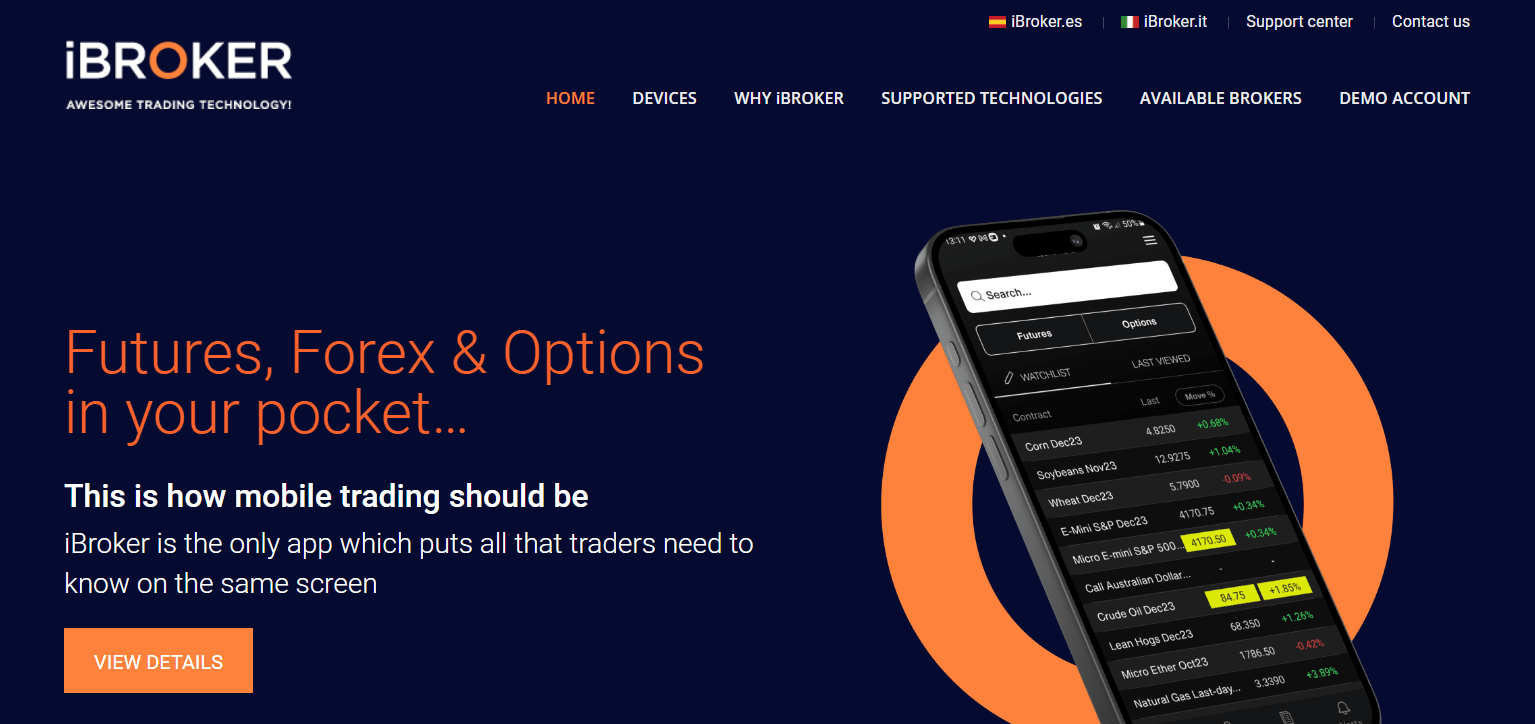

iBroker is a Spanish-regulated broker that works with traders worldwide, offering them a wide range of trading instruments with leverage of up to 1:30 on its partners’ platforms.

Brief Look at iBroker

iBroker is a company based in Spain, and established in 2002. It provides online trading services, allowing its clients to trade various financial instruments, including Forex, stocks, options, and futures. The broker offers access to both derivative instruments in the form of CFDs and underlying assets (through partner platforms). iBroker is regulated by the Spanish financial supervisory body CNMV (Comisión Nacional del Mercado de Valores), and its clients' funds are protected by the FOGAIN (Fondo General de Garantía de Inversiones) fund. Its services are available not only to residents of Spain but also to traders from other countries. In the U.S., it is possible only through partners. iBroker is integrated with brokers such as AMP Global, Dorman Trading, StoneX, Aarna, and others.

- Compliance with the requirements and rules of the Spanish regulatory authority CNMV.

- Access to a wide range of financial instruments, including through accounts and partner brokers’ platforms.

- Investment protection up to €100,000 through the FOGAIN compensation fund.

- Trading is possible from any desktop or mobile device.

- Support for convenient, and secure methods of fund deposit and withdrawal.

- Educational materials for both beginners and experienced traders.

- Integration with nine brokers, including those based in the United States.

- Lack of popular investment solutions among Forex traders, such as copy trading, PAMM, and MAM accounts.

- No access to MetaTrader and cTrader trading platforms.

- The company does not provide 24-hour support.

TU Expert Advice

Financial expert and analyst at Traders Union

iBroker is a regulated and secure broker with a wide range of trading platforms and high-quality service. The available trading instruments, user interface, client support, and compliance with regulatory requirements at iBroker are at a satisfactory level. However, the broker has its drawbacks. Its commissions are higher than those of its competitors. Additionally, it does not offer MetaTrader trading platforms, which are particularly popular among traders in the Forex and CFD markets.

iBroker has its trading platforms, including mobile applications. They provide access to real-time quotes, advanced charting tools, and the ability to execute trades from any internet-connected device. iBroker also opens access to trading on the platforms of partner brokers if the client has an active trading account with them.

Large banks serve as liquidity providers for iBroker, which, combined with direct market access, ensures that its clients receive the fastest execution at the best prices. Risk warnings and tables with transaction and commission fees are readily available on the broker's website, as required by the CNMV regulator. The support service provides knowledgeable and personalized responses, and registered clients at the broker can seek assistance from a personal account manager.

iBroker Summary

| 💻 Trading platform: | Proprietary web platform and mobile applications of iBroker; TradingView, StoneX, S5 Mobile, CQG, dt Pro, PatSystems, AARNA iBroker, RJO Futures Pro Mobile, Direct API, and others |

|---|---|

| 📊 Accounts: | Demo, real |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Bank transfer via CaixaBank and Banco de Sabadell, cash replenishment at a bank branch |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0 pips |

| 🔧 Instruments: | Forex, CFDs on indices, metals, energies, stocks, cryptocurrencies, ETFs, bonds, options, futures, and securities |

| 💹 Margin Call / Stop Out: | 200%/50% |

| 🏛 Liquidity provider: | 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | The choice of available assets depends on the trading platform and account type |

| 🎁 Contests and bonuses: | No |

For retail traders, iBroker offers leverage following regulatory requirements. The maximum leverage of 1:30 is available for pairs with major currencies (EUR, USD, JPY, GBP, CAD, and CHF). For other currencies, CFDs on gold, and major indices, the maximum trading leverage is 1:20. For secondary indices, it's 1:10; for stocks, it's 1:5; and for cryptocurrencies, it's 1:2. Trading with the instruments provided by a specific broker, whose account is linked to the trader's iBroker account, is available on both demo and real accounts.

iBroker Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

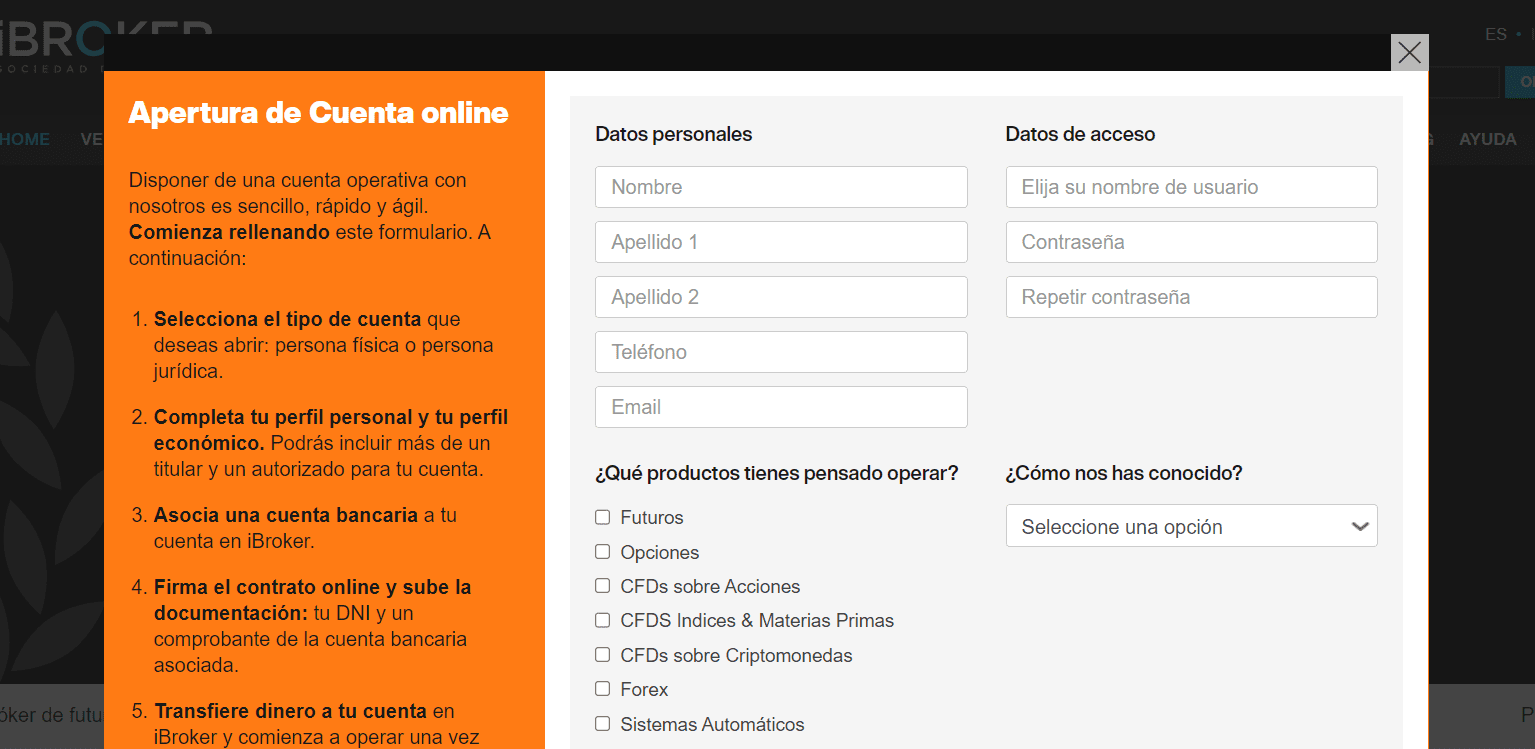

To access the client’s portal, create a user account on the iBroker website. Choose iBroker, and follow the instructions provided below.

Request the opening of a real account on the main page of the website.

Next, select the account type and assets you plan to trade. Then, complete your profile, and provide financial information, confirm your bank account, sign the online agreement, and upload the necessary documents.

After the company verifies your documents and opens the account, you can make a deposit and start trading.

Regulation and Safety

Since 2016, iBroker has been regulated by the CNMV (Comisión Nacional del Mercado de Valores), the state financial supervisory authority of Spain. iBroker is listed in the CNMV registry under number 260. As a CNMV-regulated broker, iBroker is also registered with FOGAIN (Fondo General de Garantía de Inversiones), the general fund for guaranteeing investments in Spain. FOGAIN provides a certain level of protection for investors in the event of iBroker's bankruptcy and can cover part of their losses, up to €100,000.

In addition to protecting individual investors who have invested capital in trading financial instruments through the FOGAIN fund, iBroker also ensures the safety of deposits entrusted to it by its traders. To achieve this, it holds clients' funds and assets in major banks such as Saxo Bank, Altura Markets, CaixaBank, Sabadell, and Banca March.

Advantages

- Compliance with regulatory requirements of Spain and the European Union

- Negative balance protection on all retail trading accounts

- Investor protection and a high level of financial security

Disadvantages

- Access to trading complex financial instruments with higher risk

- iBroker operates with a limited range of banks

- The broker does not compensate clients for losses incurred due to unsuccessful trading

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | From $3 | €0-2 |

The commission for carrying over a position to the next day can be either negative or positive, meaning it can result in both losses and profits. The average value of iBroker fees is shown in the table below. For comparison, it also shows the average trading fees of popular Forex brokers such as RoboForex and Pocket Option.

| Broker | Average commission | Level |

|---|---|---|

|

$3 | |

|

$1 | |

|

$8.5 |

Account Types

To open a trading account with iBroker, fill out a special form on its website and upload documents confirming your identity and a bank account. Trading can commence with any amount, but it should be sufficient to cover margin requirements and the broker’s commissions.

Account types:

Traders can also open demo accounts for trading with 50,000 virtual U.S. dollars, with a demo period of 14 days.

iBroker is a retail Forex broker that provides online trading services for currency pairs, CFDs on various assets, and other derivative financial instruments.

Deposit and Withdrawal

Submitting a withdrawal request is done through the trader’s user account on the iBroker website. The broker transfers the funds to the client's confirmed bank account by providing a bank statement.

Withdrawals to third parties or to accounts not linked to the iBroker account are not possible.

The first 5 withdrawals in a calendar month are made without deduction of commission. The sixth and subsequent transfers in the current month will cost €2 per transaction.

Withdrawal requests submitted before 12:00 (GMT+1) are processed by the company on the same day; those submitted later are processed on the next business day. The crediting timeframe to the account depends on the bank and typically takes 1-2 business days on average.

Investment Options

iBroker is a broker that does not engage in the development of investment products and strategies. If a client wishes to generate passive income, they must either create their own portfolio or seek assistance from external experts. Investors can also take advantage of opportunities offered by iBroker's partner brokers, such as ready-made portfolios, capital management, social trading, etc. iBroker's trading platforms support automated trading, allowing transactions to be executed using specialized algorithms and programs.

Automated Trading Systems (ATS)

Automated (algorithmic or mechanical) systems enable the implementation of pre-defined trading strategies through special programs. Algorithms are used to automatically place trades on behalf of traders. The advantages of such trading include trading at optimal prices, minimal delays in execution, and the absence of the psychological aspect in making investment decisions.

Key features of ATS implemented on iBroker platforms include:

Once the program is activated, there is no need to be constantly connected or to be in standby mode as it automatically links to the client's account.

Three ways to deactivate the selected ATS are available such as disconnection at the moment of closing previously opened positions, from the next session, or at any time.

Traders can simultaneously work with multiple strategies using a single account.

The fee for using ATS is an additional charge to the standard rate, amounting to 0.002% for Forex, 0.05% for CFDs, and 2 USD/EUR per contract for futures (depending on the market currency).

iBroker provides access to both paid and free ATS. Each system requires a certain amount of funds to be held in the account, serving as collateral for the uninterrupted operation of the ATS program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

iBroker's Partner Program:

The Spanish regulatory authority CNMV prohibits marketing related to the advertising of investment products to retail traders in Spain. For this reason, iBroker does not offer partner programs aimed at expanding the client base through the attraction of new users.

Customer Support

Client service hours are Monday through Friday from 8:00 to 22:00 (GMT+1). The chatbot is available 24/7, but communication with a live operator is only during the company's working hours.

Advantages

- Quick response during online chats

- Various communication channels

Disadvantages

- Support team responds to emails within several hours after receiving the message

- Support department is not available 24-hours

Traders can receive assistance through the following methods:

Phone;

WhatsApp;

Email;

Online chat on the website.

After opening an account, each client is assigned a personal manager who can be directly contacted to resolve relevant problems and give answers to trading-related questions.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | iBroker Global Markets Sociedad de Valores, SA, C. de Caleruega, 102-104, Bajo A, Cdad. Lineal, 28033 Madrid, Spain |

| Regulation | CNMV |

| Official site | https://www.ibroker.com/ |

| Contacts |

+34 917 94 5 900

|

Education

iBroker periodically conducts free seminars at its offices as well as webinars online. Both broker clients and unregistered traders interested in acquiring basic knowledge or deepening their existing knowledge can participate in these events.

Comparison of iBroker with other Brokers

| iBroker | RoboForex | Pocket Option | Exness | Octa | FxPro | |

| Trading platform |

AARNA iBroker, CQG, Direct API, dt Pro, Mobile application, RJO Futures Pro Mobile, StoneX, S5 Mobile, TradingView, PatSystems | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $1 | $10 | $5 | $10 | $25 | $100 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

200% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of iBroker

Liquidity for iBroker is directly provided by banks, and quote manipulation is absent, thereby eliminating conflicts of interest between the broker and its clients. If a trader has problems with orders on the platforms, they can contact the execution service from 8:00 to 22:00 (GMT+1). Spanish-speaking staff with direct market access will assist in placing/closing/adjusting positions. iBroker's proprietary developed platforms support automated trading.

iBroker by the numbers:

iBroker has been processing financial instruments for over 20 years.

There are 20 liquidity providers.

iBroker has integration with 9 brokers.

Trading is possible with 33 currency pairs and over 200 CFDs.

Access to more than 1,500 automated systems.

iBroker is a regulated broker providing online trading services in global financial markets

iBroker offers DMA access through professional platforms from third-party developers with a paid usage model. For example, when trading on CQG, the client pays a monthly fee of $25, and iBroker additionally withholds $0.25 per contract. The range of trading instruments and broker commissions for executing trades differs across these platforms. No fee is charged for using iBroker's proprietary platforms. There are no commissions or fees for subscribing to Forex and CFD markets.

All commissions are calculated in euros at 23:00 (GMT+1) on the day of the operation at the average exchange rate. Supported order types include market, limit, stop orders, OCO (One Cancels the Other), and OSO (One Sends the Other). Carry trade (a strategy for profiting on the Forex market by exploiting different interest rates) is allowed, along with scalping and hedging.

iBroker’s analytical services:

Email order execution notifications.

Phone dealing services.

15-minute to 7-day average spreads and real-time rollovers.

Market research and analysis. The company provides tools and data to help traders make informed trading decisions, including market information, company reports, research, and price forecasts.

Advantages:

High-quality service and prompt responsiveness from client support.

Broker activities are regulated by a reputable financial authority.

iBroker offers demo accounts, allowing traders to practice and test their strategies in a risk-free environment.

Timely resolution of disputes related to trades or transactions are processed through its compliance department or regulatory bodies.

The broker provides access to trading with more than 30 currency pairs, including micro lots.

iBroker supports risk management tools. For instance, traders can set risk levels and automatically execute trades under certain conditions using stop-loss and take-profit orders.

User Satisfaction